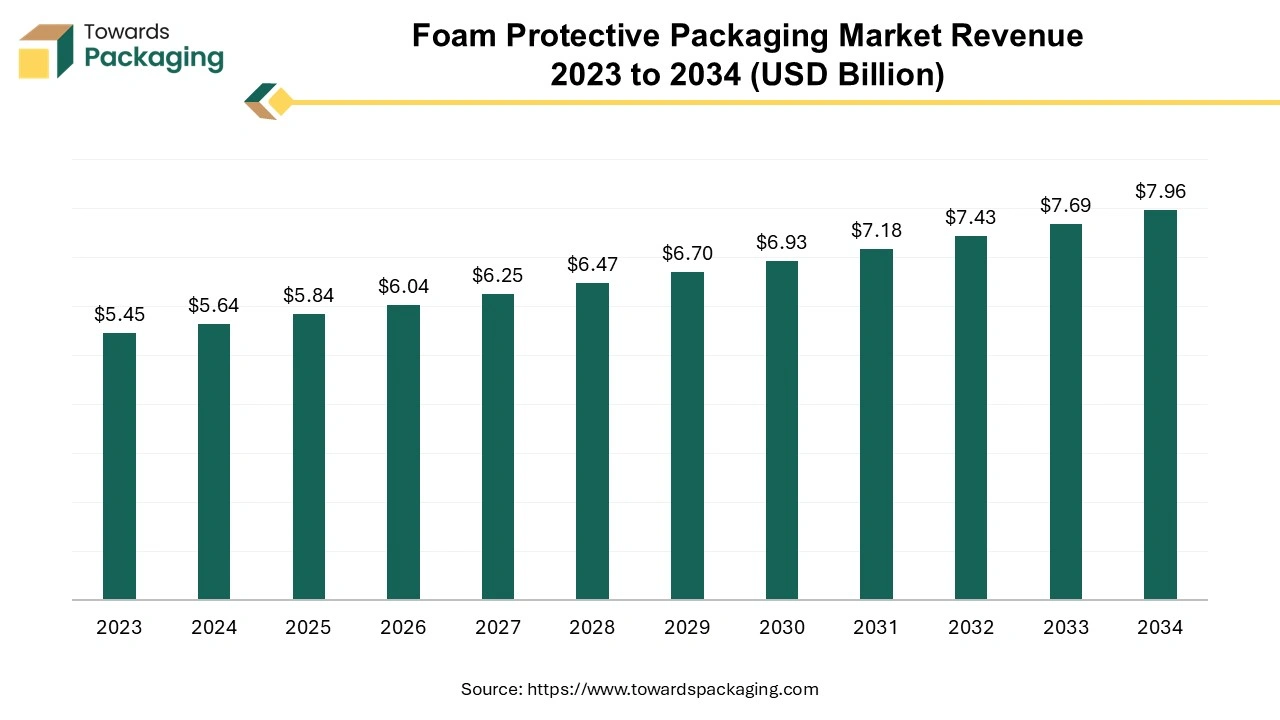

Ottawa, Feb. 20, 2025 (GLOBE NEWSWIRE) -- The global foam protective packaging market size to hit USD 7.96 billion by 2034, growing from USD 5.84 billion in 2025, expanding at 3.5% CAGR from 2025 to 2034. A study published by Towards Packaging a sister firm of Precedence Statistics.

Access Statistical Data: https://www.towardspackaging.com/download-brochure/5298

Exploring the Growth Potential of the Market

Foam-protective packaging safeguards expensive, delicate items during storage and shipment. This distinctive packaging is designed to absorb vibrations and shocks, keeping products inside the packaging safe until they reach end-users. This packaging is usually made from polyurethane, polyethylene, and expanded polystyrene. The durability and lightweight nature of foam materials make them suitable for packaging various products. The market is witnessing rapid growth due to the increasing demand for foam packaging in various industries.

Automotive, electronics, healthcare, and pharmaceutical industries rely heavily on foam protective packaging to transport their products. The excellent cushioning support and pressure-absorbing properties of this packaging make it a suitable option for packaging delicate items, such as electronic devices, glassware, and medical devices. In addition, the increase in global trade boosts the demand for protective packaging solutions, thereby boosting the market growth.

If there's anything you'd like to ask, feel free to get in touch with us @ sales@towardspackaging.com

Major Trends in the Foam Protective Packaging Market:

- Growth of E-commerce: The substantial increase in e-commerce activities drives the demand for protective packaging materials, which ensure product safety during transportation. Protective solutions have become essential because they shield products against shipping-related damage to guarantee that delivered items remain safe. Various e-commerce businesses choose lightweight foam materials because they protect delicate items from damage and lower delivery expenses. As the volume of e-commerce deliveries increases, the need for protective packaging solutions that can adapt to a range of products also increases, boosting the growth of the market.

- Technological Advancements: Advancements in packaging technologies can have a positive impact on the market. Innovations in packaging technologies lead to enhanced quality of packaging that can protect items against major threats, including forces and temperature variation. New materials and advanced procedures enable manufacturers to defend sensitive goods like electronic devices, pharmaceuticals, and perishable items across the supply chain. Advanced technologies like artificial intelligence (AI) and machine learning (ML) automate packaging manufacturing processes by automating several tasks and reducing human errors. This, in turn, enhances production efficiency while improving product quality and reducing waste generation.

- Customization & 3D Printing: 3D printing technology empowers manufacturers to generate packaging based on consumer demands. Several brands use customized packaging solutions as a marketing strategy to attract a broader consumer base. In addition, customized packaging helps to improve brand identity.

- Demand for Lightweight & Cost-effective Solutions: There is a high demand for lightweight and cost-effective packaging solutions in various industries. This trend is expected to boost the demand for foam packaging solutions since they are lightweight and durable, making them a suitable option for packing various items. Reduced weight of packaging further reduces shipping expenses.

- Focus on Product Safety: Businesses are placing strong emphasis on product safety during transit to reduce returns. They are recognizing the importance of protective packaging. Since foam packaging provides excellent cushioning and protection to delicate items during handling, the demand for this packaging is increasing across a range of industries. In addition, stringent regulations regarding product safety and packaging contribute to market growth.

Elevate your packaging with Toward Packaging. Improve efficiency and sustainability—schedule a call today: https://www.towardspackaging.com/schedule-meeting

Insights from Key Regions

Asia Pacific’s Leadership in the Foam Protective Packaging Market: What till 2034?

Asia Pacific dominated the market in 2024 by capturing the largest share. This is mainly due to the rise of e-commerce. The region is expected to sustain its dominance in the market in the near future. Rising industrialization further contributes to market growth. As industries expand, the volume of industrial goods also increases.

This, in turn, boosts the demand for robust packaging solutions that can protect goods during shipping. China and India are expected to lead the Asia Pacific foam protective packaging market. China is the largest producer of packaging products. In addition, there is a high adoption rate of packaged consumer goods. Furthermore, stringent regulations regarding plastic use support market growth.

North America’s Influence on the Market

North America is expected to experience the fastest growth in the coming years. This is mainly due to the rising trend of online shopping and increasing consumption of packaged food, which boosts the demand for protective packaging solutions that ensure safe shipping. The U.S. is projected to emerge as a leader in the North American foam protective packaging market. This is primarily due to a ban on single-use plastic and government regulations to reduce plastic packaging waste. Moreover, the rising demand for sustainable packaging solutions due to the growing concerns about environmental sustainability contributes to regional market expansion.

Market Opportunity

The rising demand for sustainable packaging solutions is likely to create immense opportunities in the foam protective packaging market. As businesses focus on sustainability practices, the demand for eco-friendly foam packaging increases. This encourages packaging manufacturers to direct their focus toward developing foam materials that can be recycled and easily decompose naturally. Stringent regulations imposed by governments to reduce packaging waste and environmental regulations are also expected to fuel the growth of the market during the forecast period.

- In July 2024, ProAmpac introduced ProActive Recyclable Fresh Foam Tray FT-1000 made from polypropylene. The ProActive Recyclable Fresh Foam Tray FT-1000 serves food and grocery markets. This lightweight, recyclable solution is an alternative to regular foam containers.

Join now to access the latest packaging industry segmentation insights with our Annual Membership: https://www.towardspackaging.com/get-an-annual-membership

Foam Protective Packaging Market Segment

- By type, the polyurethane foam segment dominated the market in 2024. This is mainly due to the increased use of packaging made from polyurethane foam. This material is favored for its ability to absorb impact and vibrations. Its resistant to wear and tear properties make it suitable for manufacturing durable packaging solutions. Polyurethane foam packaging also provides thermal insulation, making it ideal for packaging a range of food items.

- By application, the automotive and auto components segment dominated the market in 2024. This is mainly due to the increased production of electronic components for vehicles. Fragile automotive parts require protective packaging during transit. Foam packaging withstands the rigors of shipping and handling, ensuring parts are delivered safely to the end users.

Competitive Landscape

Some of the key players in the Foam Protective Packaging Market are Sealed Air Corporation, Sonoco Products Company, BASF SE (Germany), Dart Container Corporation, Pactiv LLC, WinCup, Genpak, Zotefoams Plc (U.K.), Arkema (France), Kaneka Corporation (Japan), Rogers Corporation (U.S.), Synthos SA (Poland), Armacell (Germany), JSP (Japan), and Foampartner Group (Switzerland) and Pregis LLC. These players are trying to hold the maximum market share as well as aiming to gain a competitive edge.

In May 2024, Specialized Packaging Group (SPG) announced the acquisition of Illinois-based Clark Foam Corporation (Clark or Clark Foam), which provides custom-designed packaging and foam fabrication solutions for various industries. CEO of SPG, Paul Budsworth, said “The addition of Clark Foam to our rapidly expanding team means we will be adding industry-leading custom-engineered packaging capabilities to an operation that is already world-class. We are also excited to strengthen our presence in the Chicago and Louisville areas, as well as the Midwest market broadly, allowing us to better serve our customers while providing high-quality packaging solutions to a diverse customer base.

More Insights in Towards Packaging:

- The global pre-made pouch packaging market size is estimated to reach USD 17.46 billion by 2033, up from USD 11.05 billion in 2023, at a compound annual growth rate (CAGR) of 4.82% from 2024 to 2033.

- The global corrugated mailers market size reached US$ 4.18 billion in 2023 and is projected to hit around US$ 8.99 billion by 2034, expanding at a CAGR of 7.30% during the forecast period from 2024 to 2033.

- The global green packaging film market size reached US$ 11.55 billion in 2023 and is projected to hit around US$ 19.85 billion by 2033, expanding at a CAGR of 5.93% during the forecast period from 2024 to 2033.

- The global transit packaging market size reached US$ 231.25 billion in 2023 and is projected to hit around US$ 454.48 billion by 2033, expanding at a CAGR of 6.99% during the forecast period from 2024 to 2033.

- The global paper machinery market size reached US$ 3.83 billion in 2023 and is projected to hit around US$ 5.41 billion by 2033, expanding at a CAGR of 4.43% during the forecast period from 2024 to 2033.

- The global semiconductor packaging market size reached US$ 41.05 billion in 2023 and is projected to hit around US$ 108.82 billion by 2033, expanding at a CAGR of 10.24% during the forecast period from 2024 to 2033.

- The global adherence packaging market size reached US$ 1.1 billion in 2023 and is projected to hit around US$ 2.05 billion by 2033, expanding at a CAGR of 6.43% during the forecast period from 2024 to 2033.

- The global ethical label market size is estimated to reach USD 1815.34 billion by 2033, up from USD 948.65 billion in 2023, at a compound annual growth rate (CAGR) of 6.83% from 2024 to 2033.

- The global corrugated boxes market size reached USD 163.07 billion in 2023 and is projected to hit around USD 269.19 billion by 2033, expanding at a CAGR of 5.14% during the forecast period from 2024 to 2033.

- The global bioplastic packaging market size reached US$ 17.99 billion in 2023 and is projected to hit around US$ 87.98 billion by 2033, expanding at a CAGR of 17.2% during the forecast period from 2024 to 2033.

Recent Developments in the Market

- In December 2024, Stora Enso announced the expansion of its packaging products with a new portfolio of bio-based foams, Fibrease and Papira, made from Forest Stewardship Council-approved wood. These FSC-certified products, which the company has tested at real recycling facilities, are fully recyclable and can be used for protective and thermal packaging.

- In February 2024, Pregis, a manufacturer of protective packaging solutions, introduced new protective foam packaging, which incorporates certified-circular polyethylene (PE) resins. This foam packaging has been developed in response to growing consumer demand for sustainable packaging options.

- In February 2023, Pactive Evergreen collaborated with AmSty and introduced innovative foam polystyrene packaging products that contain post-consumer recycled materials obtained through advanced recycling systems.

Segments Covered in the Report

By Type

- Polyurethane Foam

- Expanded Polystyrene

- Expanded Polyethylene

- Expanded Polypropylene

- Others

By Application

- Automotive and Auto Components

- White Goods and Electronics

- Pharmaceutical and Medical Devices

- Daily Consumer Goods

- Food

- Others

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa (MEA)

Review the Full TOC for the Foam Protective Packaging Market Report: https://www.towardspackaging.com/table-of-content/foam-protective-packaging-market-sizing

Invest in Premium Global Insights @ https://www.towardspackaging.com/price/5298

If you have any questions, please feel free to contact us at sales@towardspackaging.com

About Us

Towards Packaging is a leading global consulting firm specializing in providing comprehensive and strategic research solutions. With a highly skilled and experienced consultant team, we offer a wide range of services designed to empower businesses with valuable insights and actionable recommendations. We stay abreast of the latest industry trends and emerging markets to provide our clients with an unrivalled understanding of their respective sectors. We adhere to rigorous research methodologies, combining primary and secondary research to ensure accuracy and reliability. Our data-driven approach and advanced analytics enable us to unearth actionable insights and make informed recommendations. We are committed to delivering excellence in all our endeavours. Our dedication to quality and continuous improvement has earned us the trust and loyalty of clients worldwide.

Browse our Brand-New Journal:

Precedence Research | Statifacts | Towards Healthcare | Towards Automotive | Towards Dental | Towards EV Solutions | Nova One Advisor | Healthcare Webwire | Packaging Webwire | Automotive Webwire

For Latest Update Follow Us: https://www.linkedin.com/company/towards-packaging/